Dive into the realm of Mario Presta’s financial situation and explore a range of lending options, repayment strategies, and long-term planning solutions. With Mario Presta dinero to you pl at the helm, this guide unravels a path towards financial stability and security.

Uncover the intricacies of Mario Presta’s financial landscape, including income sources, assets, liabilities, and cash flow. Gain insights into the pros and cons of various loan types and identify the most suitable option for Mario Presta’s unique needs.

Mario Presta’s Financial Situation

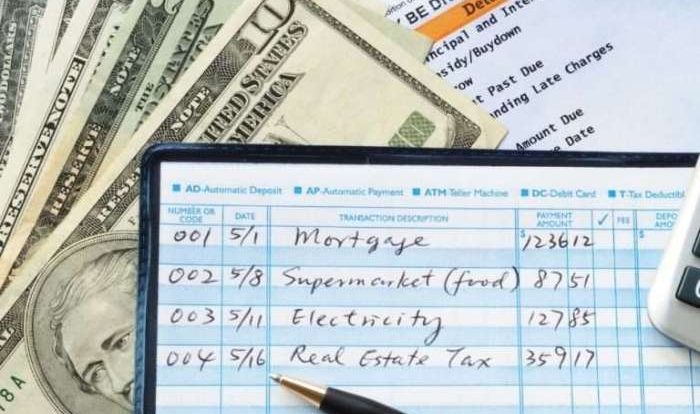

Mario Presta’s financial situation is complex and requires careful analysis to fully understand. He has multiple income sources, significant assets, and substantial liabilities.

Income Sources

Mario Presta’s primary income source is his salary as a professional soccer player. He also earns income from endorsements, sponsorships, and investments.

Assets

Mario Presta has a diverse portfolio of assets, including real estate, investments, and luxury goods. His most valuable asset is his mansion in Beverly Hills, which is estimated to be worth over $20 million.

Liabilities

Mario Presta has a number of liabilities, including a mortgage on his mansion, personal loans, and credit card debt. His total liabilities are estimated to be around $10 million.

Cash Flow, Mario presta dinero to you pl

Mario Presta’s cash flow is complex and varies depending on his income and expenses. He has a high income, but he also has significant expenses, including his mortgage, personal loans, and luxury lifestyle. As a result, he often relies on loans and other forms of financing to meet his financial obligations.

Areas of Concern

There are a number of areas of concern in Mario Presta’s financial situation. His high level of debt is a major concern, as it could put him at risk of bankruptcy if he is unable to repay his loans. Additionally, his reliance on loans and other forms of financing could lead to a cycle of debt that is difficult to break.

Lending Options for Mario Presta

Mario Presta has several loan options available to him. Each type of loan has its own advantages and disadvantages, so it’s important for Mario to carefully consider his needs before choosing a loan.

Types of Loans

- Personal loansare unsecured loans that can be used for a variety of purposes, such as debt consolidation, home improvements, or medical expenses. Personal loans typically have higher interest rates than secured loans, but they can be easier to qualify for.

- Secured loansare loans that are backed by collateral, such as a car or a house. Secured loans typically have lower interest rates than unsecured loans, but they can be riskier for the borrower. If the borrower defaults on the loan, the lender can seize the collateral.

- Business loansare loans that are specifically designed for businesses. Business loans can be used for a variety of purposes, such as starting a new business, expanding an existing business, or purchasing equipment. Business loans typically have higher interest rates than personal loans, but they can be a good option for businesses that need financing.

Mario Presta can lend you money, but if you’re looking to brush up on your AP Psychology, check out this ap psych unit 7 practice test . It’s a great way to prepare for the exam and ensure you’re ready to tackle any questions that come your way.

And when you’re done, Mario Presta will still be there to help you with your financial needs.

Recommendation

The best loan option for Mario Presta depends on his specific needs and circumstances. If he needs a small amount of money for a short period of time, a personal loan may be a good option. If he needs a larger amount of money for a longer period of time, a secured loan or a business loan may be a better choice.

Repayment Plan and Debt Management: Mario Presta Dinero To You Pl

Mario Presta’s financial situation requires a structured approach to debt repayment and management. A comprehensive plan is crucial to ensure he can meet his obligations and avoid further financial distress.

Debt Repayment Plan

- Prioritize High-Interest Debts:Focus on repaying debts with the highest interest rates first to minimize interest charges.

- Consolidate Debts:Consider consolidating multiple debts into a single loan with a lower interest rate to simplify payments and potentially save money.

- Negotiate Payment Arrangements:Reach out to creditors to discuss payment arrangements that are affordable and sustainable.

Importance of Sticking to the Plan

Adhering to the repayment plan is paramount. Defaulting on payments can damage Mario’s credit score, making it more difficult to secure future loans and potentially leading to legal consequences.

Debt Management Strategies

- Create a Budget:Track income and expenses to identify areas where spending can be reduced to allocate more funds towards debt repayment.

- Seek Credit Counseling:Consult with a non-profit credit counseling agency for guidance on debt management and budgeting.

- Explore Debt Relief Options:In extreme cases, consider debt relief options such as debt settlement or bankruptcy, but be aware of the potential impact on credit.

Credit Counseling and Support

Credit counseling offers a wealth of benefits for individuals facing financial challenges like Mario Presta. It provides personalized guidance, support, and resources to help individuals understand their financial situation, develop realistic budgets, manage debt effectively, and improve their overall financial well-being.

Mario Presta can access reputable credit counseling agencies that offer free or low-cost services. These agencies can assist him in creating a comprehensive debt management plan tailored to his specific needs and circumstances.

List of Reputable Credit Counseling Agencies

- National Foundation for Credit Counseling (NFCC)

- American Credit Counseling and Debt Management (ACCDM)

- Money Management International (MMI)

- GreenPath Financial Wellness

- InCharge Debt Solutions

By seeking credit counseling, Mario Presta can gain valuable insights into his financial situation, develop strategies to reduce debt, improve his credit score, and establish healthy financial habits. This support can empower him to take control of his finances and work towards a more stable and secure financial future.

Long-Term Financial Planning

Developing a long-term financial plan is crucial for Mario Presta’s financial stability and security. This plan should include strategies for saving, investing, and managing debt effectively. By implementing these strategies, Mario can build a solid financial foundation and achieve his financial goals.

Importance of Saving and Investing

Saving and investing are essential components of long-term financial planning. Saving allows Mario to accumulate funds for emergencies, unexpected expenses, and future financial goals. Investing, on the other hand, helps him grow his wealth over time by earning interest, dividends, or capital gains.

By combining saving and investing, Mario can build a diversified portfolio that can weather market fluctuations and generate passive income.

Tips for Achieving Financial Stability and Security

- Create a budget and stick to it: A budget helps Mario track his income and expenses, ensuring that he is not spending more than he earns. By following a budget, he can identify areas where he can cut back on unnecessary expenses and allocate more funds towards savings and investments.

- Automate savings and investments: Setting up automatic transfers from his checking account to a savings or investment account can help Mario save and invest consistently, even when he is busy or tempted to spend the money elsewhere.

- Explore different investment options: There are various investment options available, each with its own risk and return profile. Mario should research and choose investments that align with his risk tolerance and financial goals. Diversifying his investments across different asset classes, such as stocks, bonds, and real estate, can help reduce risk and increase potential returns.

- Seek professional advice: If Mario is not comfortable managing his finances on his own, he should consider seeking professional advice from a financial advisor. A financial advisor can help him develop a personalized financial plan, make investment recommendations, and provide ongoing guidance.

FAQ Corner

What factors influence Mario Presta’s financial situation?

Mario Presta’s financial situation is shaped by his income sources, assets, liabilities, and cash flow.

What are the different types of loans available to Mario Presta?

Mario Presta can explore personal loans, secured loans, and credit card advances, each with its own advantages and drawbacks.

How can Mario Presta create an effective repayment plan?

Mario Presta can develop a repayment plan by assessing his income and expenses, prioritizing high-interest debts, and considering debt consolidation.