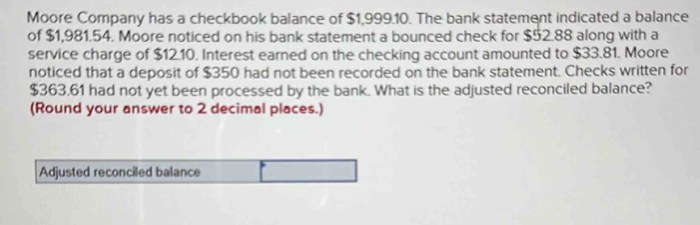

Lorenzo has a checkbook balance of 118 – Lorenzo’s checkbook balance of 118 presents an intriguing scenario, inviting us to delve into the intricacies of checkbook management and its implications on financial well-being. This analysis will dissect Lorenzo’s balance, explore the contributing factors, and offer prudent recommendations to enhance his financial health.

A checkbook balance serves as a crucial indicator of an individual’s financial standing. It reflects the difference between the funds deposited and withdrawn from a checking account, providing a snapshot of available resources. Maintaining an accurate checkbook balance is essential for responsible financial management, allowing individuals to track their spending, avoid overdrafts, and make informed financial decisions.

Overview of Checkbook Balance

A checkbook balance is a record of the amount of money available in a checking account. It is essential to maintain an accurate checkbook balance to avoid overdraft fees, track expenses, and make informed financial decisions.

Checkbook balances are used for various purposes, such as:

- Monitoring cash flow

- Reconciling bank statements

- Preparing budgets

Lorenzo’s Checkbook Balance

Lorenzo’s checkbook balance of 118 indicates that he has $118 available in his checking account. This balance could be a concern if Lorenzo has upcoming expenses that exceed this amount.

Potential implications of Lorenzo’s checkbook balance include:

- Insufficient funds to cover upcoming expenses

- Overdraft fees if checks are written for more than the available balance

- Difficulty managing expenses and staying within a budget

- Review his expenses and identify areas where he can reduce spending

- Increase his income through additional work or a side hustle

- Consider a loan or line of credit to cover short-term expenses

- Income: Regular deposits from wages, salaries, or investments increase the checkbook balance.

- Expenses: Withdrawals for purchases, bills, and other expenses decrease the checkbook balance.

- Fees: Bank fees, overdraft fees, and other charges reduce the checkbook balance.

- Errors: Mistakes in recording transactions or reconciling the checkbook balance can result in inaccuracies.

- Regularly recording all transactions, including deposits, withdrawals, and fees.

- Reconciling the checkbook balance with the bank statement to identify and correct any errors.

- Tracking expenses to identify areas where spending can be reduced.

- Setting financial goals and creating a budget to ensure the checkbook balance remains positive.

- Cover unexpected expenses

- Avoid debt and high-interest charges

- Save for future financial goals

- Overdraft fees and penalties

- Difficulty paying bills on time

- Increased stress and financial instability

Lorenzo should consider the following recommendations:

Factors Influencing Checkbook Balance

Several factors can influence a checkbook balance, including:

These factors interact with each other to determine the overall checkbook balance. For example, an increase in income or a decrease in expenses will typically result in a higher checkbook balance, while an increase in fees or an error can lead to a lower checkbook balance.

Managing Checkbook Balance

Effective checkbook balance management involves:

By following these best practices, individuals can avoid common mistakes that can affect their checkbook balance, such as overspending, neglecting to reconcile, and making errors in recording transactions.

Impact of Checkbook Balance on Financial Health: Lorenzo Has A Checkbook Balance Of 118

A healthy checkbook balance is essential for financial stability. It allows individuals to:

Conversely, a negative checkbook balance can lead to financial difficulties, such as:

Maintaining a positive checkbook balance is crucial for overall financial well-being.

Frequently Asked Questions

What factors can influence a checkbook balance?

Income, expenses, deposits, withdrawals, and bank fees are common factors that impact a checkbook balance.

How can I avoid common mistakes that affect a checkbook balance?

Regularly reconcile your checkbook, avoid overdraft fees, and be mindful of hidden expenses.